mgfoto.ru

Prices

How To Earn Money On Twitter

Previously, people only made money from Twitter through affiliate marketing, product reviews, sponsored content, and Super Follows. Twitter has always been a great app for keeping up with sports, events, and people you're interested in. It's technically still that nowadays, but the. Ticketed Spaces helps you create unique and exclusive live audio experiences in Twitter Spaces, ones your audience is willing to pay for. You can add as many media and social network accounts as you like. If you are a writer, sign up and earn money for writing content for advertisers. make more money all day, all night, every day. Excpect Mo'. Mobile Application New York mgfoto.ru Joined February 1, Following. Description · You Are Going To Understand That If You Want To Be Successful On The Internet, You Must Have A La-ser Focus On How You're Going To Make Money. 11 Ways to Make Money on Twitter · 1. Become a Ghostwriter · 2. Affiliate Marketing · 3. Build Your Email List · 4. Promote Your Business · 5. Post Sponsored. So, if you have , followers and the hostel-finding app pays $1 per 1, followers, you can earn $ for a single tweet. However, you may make more if. Now you can apply to try Ticket Spaces and Super Follows with your audience. Earn money and engage with your followers in exciting new ways. Previously, people only made money from Twitter through affiliate marketing, product reviews, sponsored content, and Super Follows. Twitter has always been a great app for keeping up with sports, events, and people you're interested in. It's technically still that nowadays, but the. Ticketed Spaces helps you create unique and exclusive live audio experiences in Twitter Spaces, ones your audience is willing to pay for. You can add as many media and social network accounts as you like. If you are a writer, sign up and earn money for writing content for advertisers. make more money all day, all night, every day. Excpect Mo'. Mobile Application New York mgfoto.ru Joined February 1, Following. Description · You Are Going To Understand That If You Want To Be Successful On The Internet, You Must Have A La-ser Focus On How You're Going To Make Money. 11 Ways to Make Money on Twitter · 1. Become a Ghostwriter · 2. Affiliate Marketing · 3. Build Your Email List · 4. Promote Your Business · 5. Post Sponsored. So, if you have , followers and the hostel-finding app pays $1 per 1, followers, you can earn $ for a single tweet. However, you may make more if. Now you can apply to try Ticket Spaces and Super Follows with your audience. Earn money and engage with your followers in exciting new ways.

There are sites you can link to your Twitter account, which support your tweets with ads that earn you money based on the number of clicks on these ads. 1. Become an adept X user. No one with rudimentary X skills can make money on X. You need to be good at getting followers to your accounts, using multiple. With the growing popularity of social media platforms, there is a third way for content creators to earn revenue for their content. It involves social media. A completed Twitter profile will help your followers get to know you and build a trusting relationship with you or your brand. Step 2: Getting a following. A: To earn money from your tweets, you must get approved in the Twitter monetization program, which requires users to meet the minimum. Get paid for what you post on Twitter. Accept tips and start earning from your Tweets. Start Earning Tips It's free, and quick to get started. Twitter offers a unique blend of opportunities for monetization, from sponsored tweets to affiliate marketing and beyond. Stripe's flexible APIs helped X launch Ticketed Spaces and Super Follows, where creators can earn money by creating an extra level of conversation for their. Most social media platforms have a sponsored post setup. Twitter even has a direct link to sign up for their sponsored posts. Visit Sponsored Tweets to match. How X (Formerly Twitter) Makes Money. Advertising and data licensing How Companies Make Money · IBM · Micron · Snapchat · Spotify · Twitter. CURRENT ARTICLE. 1. Build a niche-focused Twitter account. · 2. Attract a targeted follower base. · 3. Share valuable content regularly. · 4. Engage with your. X, formerly known as Twitter, is making it possible for content creators and influencers to earn on the platform. CEO Elon Musk announced a major revision. Ads revenue sharing lets you share revenue from verified user's organic This is part of our effort to help people earn a living directly on X. To be considered eligible for creator ads revenue sharing you must: Be subscribed to Blue or Verified Organizations. (common knowledge). - Have at least 15M. Yes, it's possible to earn money on Twitter, and some say sponsored tweets are one of the most common ways to do so. To earn money from tweets. Twitter is an excellent way to connect with influencers and experts in your field. By tweeting and engaging with people who have a larger following, you can get. If you're wondering how to get followers on Twitter and also increase engagement, we have good news: some of the strategies for both are interwoven. Many social. In addition, if you earn money or currency from X via any of our creator monetization products, you are subject to X's Creator Monetization Standards, which. New Play To Earn Games This August ! Here are the newest play-to-earn games listed on our website that you can add to your list! Intro0.

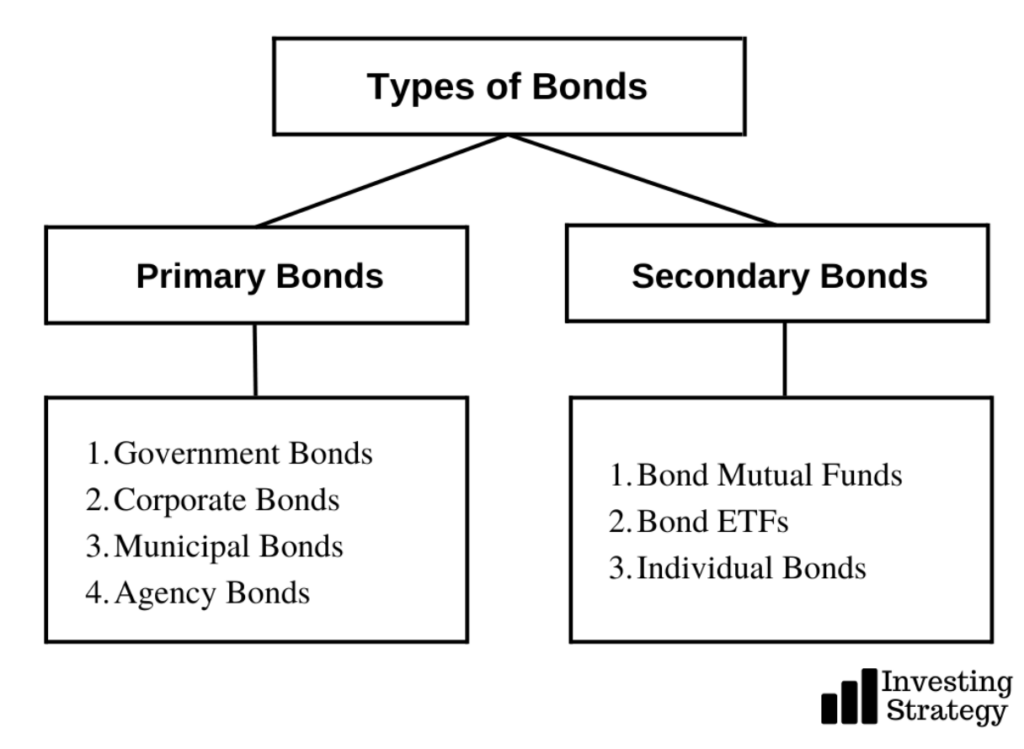

What Type Of Bonds Should I Invest In

What types of bonds are there? · Treasury Bills. Short-term securities maturing in a few days to 52 weeks · Notes. Longer-term securities maturing within ten. The most commonly known fixed income investments are government and corporate bonds, but CDs and money market funds are also types of fixed income. The U.S. bond market is the largest securities market in the world. It's made up of three primary types of bonds: corporate, Treasury and municipal bonds. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. 1. Zero coupon bonds · 2. Convertible bonds · 3. Corporate bonds · 4. Government bonds · 5. High yield / junk bonds · 6. Investment grade bonds · 7. Fixed rate bonds. Not sure whether to choose bonds or bond funds? Learn the key factors to consider, including your investment goals, time horizon, and risk tolerance. Since mortgage-backed bonds are normally considered to have more risk than U.S. Treasury securities, they typically offer higher interest rates. For that reason. What is a bond? · Mutual fund. A type of investment that pools shareholder money and invests it in a variety of securities. Each investor owns shares of the fund. What types of bonds are there? · Treasury Bills. Short-term securities maturing in a few days to 52 weeks · Notes. Longer-term securities maturing within ten. The most commonly known fixed income investments are government and corporate bonds, but CDs and money market funds are also types of fixed income. The U.S. bond market is the largest securities market in the world. It's made up of three primary types of bonds: corporate, Treasury and municipal bonds. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. 1. Zero coupon bonds · 2. Convertible bonds · 3. Corporate bonds · 4. Government bonds · 5. High yield / junk bonds · 6. Investment grade bonds · 7. Fixed rate bonds. Not sure whether to choose bonds or bond funds? Learn the key factors to consider, including your investment goals, time horizon, and risk tolerance. Since mortgage-backed bonds are normally considered to have more risk than U.S. Treasury securities, they typically offer higher interest rates. For that reason. What is a bond? · Mutual fund. A type of investment that pools shareholder money and invests it in a variety of securities. Each investor owns shares of the fund.

Bonds are safer for a reason⎯ you can expect a lower return on your investment. Stocks, on the other hand, typically combine a certain amount of. Some areas of potential opportunity include investment-grade corporate bonds, mortgage-backed securities, and securities backed by consumer credit cards, auto. You'll probably want to steer clear of riskier high-yield bonds - also known as junk bonds. NEXT: How should I buy bonds? The most common types include Treasury bonds, corporate bonds, municipal bonds, agency bonds, and savings bonds. They all have different sellers, purposes. The three major types of bonds are corporate, municipal, and Treasury bonds: Corporate bonds are debt instruments issued by a company to raise capital for. A supranational institution. Ranked below States, this type of body may also issue bonds (e.g. the European Investment Bank, This type of bond should be. Cash – including high-yield savings accounts, short CDs – money market funds, and bond funds, are all perceived as relatively “safe” investments but differ in. Bonds provide fixed income payments, offering a predictable and steady stream of income. · Investing in bonds can help lower risk when compared to stocks and. Building a strong bond core involves investing in a range of debt instruments of various maturity dates, coupon rates, issuers, and credit ratings. You can do. Instead, high-quality bonds, including Treasury bonds and corporate debt securities, can be a better choice for portfolio diversification. Bond issuers from. While you might automatically think about stocks when you begin to plan your investing strategy, bonds are another type of investment asset that help you. If you are looking for predictable value and certainty for your financial goals, then individual bonds may be a better fit. Meanwhile, if you are looking for. Bonds and bond funds can be an important component of a diversified investment portfolio. They can be helpful for anyone concerned about capital preservation. Bonds provide fixed income payments, offering a predictable and steady stream of income. · Investing in bonds can help lower risk when compared to stocks and. Here are some of the different types of investment bonds available to investors: Corporate bonds: These are issued by private corporations. The debt can be paid. (or equity), cash, and other investments. Investors also can diversify the types of bonds they hold. For example, investors could buy bonds of different. Each investor must determine how much risk they are comfortable with – their risk tolerance level. It is generally advised to match one's investment goals with. U.S. government and U.S. government agency bonds are considered the safest bond investments. They are not insured but are backed by the "full faith and credit". Broadly speaking, government bonds and corporate bonds remain the largest sectors of the bond market, but other types of bonds, including mortgage-backed. Types of bonds · GOVERNMENT BONDS · Risk Considerations: Among the lowest risk of all bond investments, these bonds have low credit risk because they are backed.

The Best Way To Use A Secured Credit Card

You deposit a certain amount with the credit card company, known as a security deposit, and that money is returned to you when you close your credit card. A secured credit card account is beneficial to building credit only if you use it properly. This type of account provides you the opportunity to demonstrate. Secured credit cards work similarly to debit cards in that you're using your own money as insurance for transactions, rather than borrowing funds from a lender. If you have no credit or low credit, a secured card can provide you with a path to building or repairing your credit. As you use your card, you'll earn rewards. A secured credit card account is beneficial to building credit only if you use it properly. This type of account provides you the opportunity to demonstrate. With a secured credit card, you put down a security deposit upfront that's equal to your credit limit (typically around $), and your activity on that card is. Get details on the security deposit. · Check out spending limits. · Explore additional expenses. · Determine the type of inquiry the credit card company will use. Secured credit cards work just like credit cards, but they're tied to a refundable security deposit that the borrower pays. You can apply for a secured credit card in the same way that you would apply for a regular credit card. They are issued by nearly all of the leading credit card. You deposit a certain amount with the credit card company, known as a security deposit, and that money is returned to you when you close your credit card. A secured credit card account is beneficial to building credit only if you use it properly. This type of account provides you the opportunity to demonstrate. Secured credit cards work similarly to debit cards in that you're using your own money as insurance for transactions, rather than borrowing funds from a lender. If you have no credit or low credit, a secured card can provide you with a path to building or repairing your credit. As you use your card, you'll earn rewards. A secured credit card account is beneficial to building credit only if you use it properly. This type of account provides you the opportunity to demonstrate. With a secured credit card, you put down a security deposit upfront that's equal to your credit limit (typically around $), and your activity on that card is. Get details on the security deposit. · Check out spending limits. · Explore additional expenses. · Determine the type of inquiry the credit card company will use. Secured credit cards work just like credit cards, but they're tied to a refundable security deposit that the borrower pays. You can apply for a secured credit card in the same way that you would apply for a regular credit card. They are issued by nearly all of the leading credit card.

How does a secured credit card work? · A One-Time, Refundable Deposit: Secured credit cards usually have more lenient qualifications because the deposit is used. First Progress Platinum Elite Mastercard® Secured Credit Card · Choose your own credit line – $ to $ – based on your security deposit · Build your credit. A secured credit card is a card where you set your own credit limit by making a cash security deposit when you open the account. If you have a low credit score or a limited credit history, you can start building credit with a secured credit card. Here's what you need to know. Secured cards are issued by most well-known credit card companies and banks. Similar to a credit card, you have to apply for a secured card. Once you're. The difference is that it requires a cash security deposit that the lender “holds” to secure the funds. They're an ideal way for people to build credit or. The best thing to do when you receive a secured credit card is use it for the same purposes you would a traditional card. Experts suggest you apply the same. How do secured credit cards work? A secured credit card requires a security deposit equal to the card's credit limit. This ensures that the money being spent. Use your Secured Credit Card responsibly to help build, or rebuild, your credit history. If you are new to credit cards or are trying to take the right. With a secured credit card, your low limit can help you learn and master the skills necessary to use credit effectively. When you're able to transition to an. To get a secured credit card, you need to provide a cash deposit—usually $$—which usually matches your credit limit and will be held by the lender in. “Regardless of whether it's a secured or an unsecured card, it's an opportunity for the consumer to use a credit product responsibly, which gives them an. The Discover it® Secured Credit Card helps you build your credit history with responsible use. It looks and acts like a traditional credit card except that. Unlike regular credit cards, which let you make purchases & pay off your debt in the future, secured credit cards require you to provide a deposit as. How to get a TD Cash Secured Credit Card · 1. Apply for the card. Apply online for the TD Cash Secured Credit Card · 2. Open a savings account. Once you're. If you've had trouble getting approved for an unsecured credit card, then a secured credit card might be a good option for you. These cards require a cash. Use your card wherever credit cards are accepted. It works just like a traditional credit card, and it looks the same, too – merchants can't tell the difference. A secured credit card is a card where you set your own credit limit by making a cash security deposit when you open the account. Your maximum credit limit will be determined by the amount of the security deposit you provide, your income and your ability to pay the credit line established. Using a tiny portion of your available credit each month and paying it off when your statement arrives is the key to establishing credit with a.

Ambetter Balanced

Ambetter Balanced Care 11 · Plan Overview · Office Visit · Prescription Drug Information · Inpatient Coverage · Emergency and Urgent Care · Maternity · Vision. Prescription Coverage. Get coverage for your medical prescriptions. Ambetter from Magnolia Health is a Qualified Health Plan issuer in the Mississippi Health. Gym Reimbursement Program. Ambetter's gym membership benefits program makes it easier to stay in shape and stay healthy. Prescription Coverage. Get coverage for. Every Ambetter insurance plan offers all of your Essential Health Benefits: Emergency services, outpatient or ambulatory services, preventive and wellness. Ambetter Balanced Care Comparison 94 Plans. In-network Benefits. Balanced Care 1 (). Balanced Care 4 (). Annual Well Visit/Screening/Immunization/Well. Prescription Coverage. Get coverage for your medical prescriptions. Ambetter from Magnolia Health is a Qualified Health Plan issuer in the Mississippi Health. Ambetter from Superior HealthPlan offers quality, affordable health insurance plans in Texas that fit your needs and budget. Apply on the Texas Marketplace. Ambetter Superior Health Plans is the Health Insurance Marketplace (HIM) option operated by CeltiCare, a subsidiary of the Centene Corporation. AmBetter offers. Balanced Care Call us today at (TDD/TTY: ) or visit us at. mgfoto.ru Page 2. Balanced Care and Silver. Ambetter Balanced Care 11 · Plan Overview · Office Visit · Prescription Drug Information · Inpatient Coverage · Emergency and Urgent Care · Maternity · Vision. Prescription Coverage. Get coverage for your medical prescriptions. Ambetter from Magnolia Health is a Qualified Health Plan issuer in the Mississippi Health. Gym Reimbursement Program. Ambetter's gym membership benefits program makes it easier to stay in shape and stay healthy. Prescription Coverage. Get coverage for. Every Ambetter insurance plan offers all of your Essential Health Benefits: Emergency services, outpatient or ambulatory services, preventive and wellness. Ambetter Balanced Care Comparison 94 Plans. In-network Benefits. Balanced Care 1 (). Balanced Care 4 (). Annual Well Visit/Screening/Immunization/Well. Prescription Coverage. Get coverage for your medical prescriptions. Ambetter from Magnolia Health is a Qualified Health Plan issuer in the Mississippi Health. Ambetter from Superior HealthPlan offers quality, affordable health insurance plans in Texas that fit your needs and budget. Apply on the Texas Marketplace. Ambetter Superior Health Plans is the Health Insurance Marketplace (HIM) option operated by CeltiCare, a subsidiary of the Centene Corporation. AmBetter offers. Balanced Care Call us today at (TDD/TTY: ) or visit us at. mgfoto.ru Page 2. Balanced Care and Silver.

Ambetter Balanced Care 9 (). Coverage Period: Beginning on or after 01/01/ Summary of Benefits and Coverage: What this Plan Covers & What it Costs. For years, Peach State Health Plan has delivered quality healthcare solutions to help Georgia residents live better. And with Ambetter, our Health Insurance. Our Qualified Health Plans are changing their name to Ambetter from Fidelis Care in The standardized plans are available to qualifying families and. Eye care is essential to how we see the world around us. Our plans include routine pediatric eye exams, eyewear and medical eye care services. See how choosing a health insurance plan that has balanced out-of-pocket costs and monthly premium payments, like an Ambetter Silver Plan, can help you save. Plan Brochures & Summaries of Benefits & Coverage ; EssentialCare$, Ambetter Essential Care: $1, Medical Deductible + Vision + Adult Dental Zero Cost. Our Health Plans show Our Health Plans menu. Health Plans · Vision Plans View essential health benefits. Find and enroll in a plan that's right for. Get plan details on Ambetter Balanced Care 4. Learn more about this Washington health insurance HMO plan from Ambetter and apply online. View essential health benefits. Find and enroll in a plan that's right for you. Join Ambetter Health show Join Ambetter Health menu. Become a Member · Become a. Ambetter Ohio - Policies · Apply Now. Ambetter Balanced Care 1 () + Vision + Adult Dental. Plan Type: HMO. Plan Tier: Silver. Medical Deductible -. If you have questions about your health insurance coverage, we'd love to hear from you. Select your state to contact an Ambetter representative in your. Ambetter from NH Healthy Families offers multiple NH health insurance plans with different levels of premium and out-of-pocket payments. Ambetter Balanced Care offers affordable health insurance for Georgia individuals and families. Benefits include unlimited office visit copayments to either a. Ambetter Balanced Care Comparison 94 Plans. In-network Benefits. Balanced Care 1 (). Balanced Care 4 (). Annual Well Visit/Screening/Immunization/Well. Fidelis Care's Qualified Health Plans are now called Ambetter from Fidelis If you recently enrolled in Child Health Plus, the Essential Plan, or a. Health Insurance Terms Glossary - Understand Your Plan | Ambetter Health Essential Health Benefits (EHBs): Health plans offered in the individual and. Eye care is essential to how we see the world around us. Our plans include routine pediatric eye exams, eyewear and medical eye care services. Ambetter Balanced Care 4 (). Coverage Period: Beginning on or after 01/01/ Summary of Benefits and Coverage: What this Plan Covers & What it Costs. Ambetter from Magnolia Health offers several levels of plan options with different types of coverage and payment. Learn more and choose your Mississippi. Carousel content with slides. The Ambetter Health mobile app is a convenient way to manage your healthcare anytime, anywhere. Access all the features of your.